Omnicom is still feeling the impacts of the pandemic.

Organic growth for Q4 declined 9.6% to $3.7 billion, a sequential improvement from Q3’s 11.7% decline, but still not back to positive territory. For the full year, organic growth declined 11.1% to $13.2 billion.

Globally, advertising decreased by 9.7% in Q4 and 12.2% for the year, with media improving sequentially by quarter. Health and pharma, food and beverage and technology clients continued to spend while travel, entertainment and oil and gas were hardest hit.

While the company has reason to be hopeful as the vaccine rolls out, there are “still significant challenges in 2021,” said CEO John Wren on the earnings call Thursday.

Omnicom “will achieve positive organic growth” in 2021, he added, but the company “must remain adaptable and vigilant.”

“Progress is being made with the vaccine, but it's going to take a little bit of time,” Wren said.

Organic growth was negative across all of Omnicom’s markets in both Q4 and for the full year. In Q4, the U.S. declined by 9.4% and the rest of North America was down 3.2%; the U.K. decreased 12.4% and the rest of Europe by 9.2%; and APAC declined 3.9%.

For the full year, both the U.S. and North America declined 10%; the U.K. was down 11.5% and the rest of Europe down 12.8%; and APAC declined 8.5%.

In the U.S., healthcare outperformed the group with a 2% decline for Q4 and a 3.3% increase for the year. PR grew organically by 0.2% in Q4 thanks to election related spending, but declined by 4.2% overall in 2020.

Omnicom’s CRM groups continued to struggle with the impact on sports and live events, with consumer experience declining 15.8% in the quarter and for the year, and execution and support declining 13.7% in the quarter and 15% for the year.

The decline was offset by performance marketing, which performed “relatively better,” Wren said.

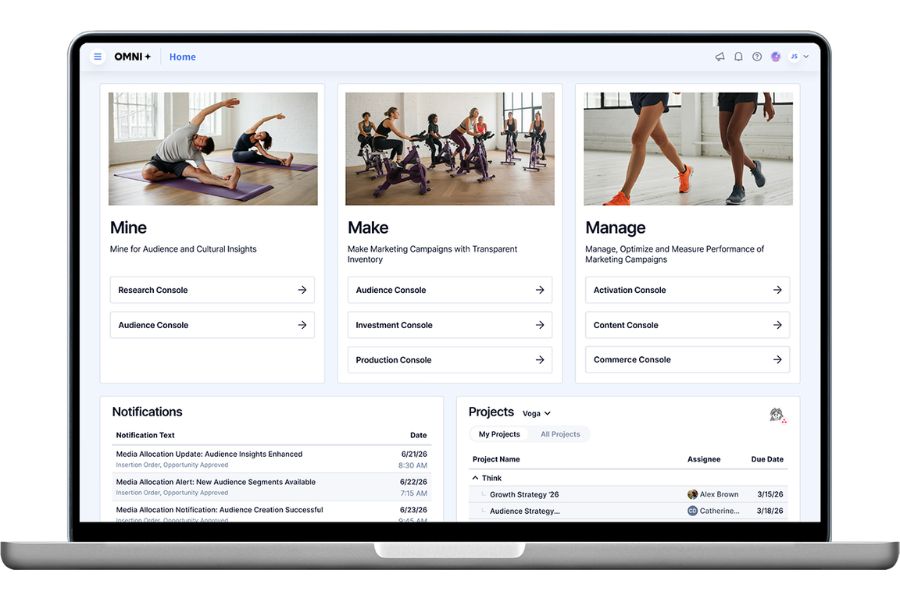

Digital transformation

As clients accelerate their digital transformation, Omnicom is doubling down on CRM, performance marketing, e-commerce, data and analytics and consulting.

The holding company has now rolled out its Omni platform, which allows clients to connect first-party data to privacy compliant third-party datasets, across most of its top clients and 60 markets around the world.

“The velocity of digital transformation picked up this year,” Wren said. “As we emerge on the other side of this pandemic, it's clear this trend is here to stay. We now have a greater opportunity to help clients accelerate digital transformation initiatives and connect with customers.”

Still, the holding company remains “steadfast in investing in leading brands and businesses,” including its creative agencies, while being “strategically organized across practice areas and clients to maximize collaboration and expertise,” he added.

As Omnicom invests in new areas, it’s ramping up training across the group, which have proven to be successful remote programs. “Remote learning will have a permanent place in our future learning and development efforts,” Wren said.

Omnicom continues on the journey to improving equity, diversity and inclusion. Its OPEN 2.0 strategy aims to achieve “systemic equity across Omnicom” and “expand and empower those responsible for leading plan implementation,” Wren said.

Since last summer, Omnicom has doubled its DE&I leadership roles across the group, and all of its networks now have a dedicated DE&I lead reporting into the CEO.

“We recognize our plan will only be successful if we have a strong base of DE&I specialists executing it throughout our agencies,” Wren said.

(This article first appeared on CampaignLive.com)