Dentsu reported slower organic growth than most of its holding company peers in 2022, as limp results in Japan and Asia hampered a more resilient showing in the Americas and Europe excluding Russia.

The Tokyo-based holding company grew 4.1% organically for the year following a surprisingly strong 13.1% pace in 2021. In recent weeks results from global competitors IPG, Omnicom and Publicis Groupe have reported their full annual growth rates in a range between 7 to 10%.

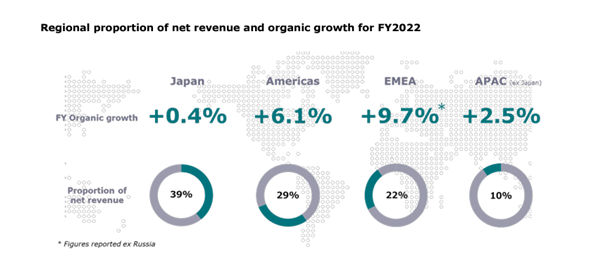

In Dentsu's home market of Japan, the slowdown was most acute, where revenues flattened (+0.4%) compared to the robust 17.9% organic growth delivered the previous year. Citing a challenging macro-environment with a slight slowdown in demand for online advertising in Q4, the company expects continued strength from digital solutions ahead.

Global Group revenues had picked up somewhat in the fourth quarter rising 3.5% on year compared to a drop of nearly 5% in Q3. Nonetheless, the pace still represented a significant slowdown from the first half of 2022 when growth in Japan, Asia and the Americas had been much stronger.

Regional breakdown

The Americas reported 6.1% growth on strong gains in Canada (+9.2%) and the US (+6.2%) which were offset by organic declines in Brazil. Dentsu's Creative business returned to growth in Q4, ending up +1% for the year.

Bucking the trend was EMEA excluding Russia, which saw much stronger growth rates as the year progressed, finishing highest among regions at 9.7% growth. Several markets, including Italy, Spain and the UK enjoyed double-digit gains in Q4 while newly-launched Dentsu Creative was credited for a "turnaround performance" for the year in addition to high single-digit growth for media.

The message to investors

Despite the slower revenue growth, Dentsu delivered more positives for its investors, reporting record annual results for underlying operating profit, basic earnings per share and dividend per share with a payout ratio increased to 32%.

The company focused on a 17.5% annual gain in the Customer Transformation and Technology division, which currently contributes nearly a third (32.3%) of Group revenues but is aiming to form 50% of Dentsu's revenue.

Dentsu has been streamlining its management over the past year and reducing its number of agency brands as it seeks to integrate its services within its domestic and international businesses.

"Our transformation continues to deliver a simplified organization with a focused strategy of growing revenues in the structural growth area of our industry, Customer Transformation & Technology," said Dentsu Group CEO Hiroshi Igarashi. "In 2023 and ahead, we remain focused on the opportunity to further consolidate and strengthen our competitive position at the convergence of marketing, technology and consulting. This distinct market position will drive value for our clients, our people and our shareholders."

Dentsu is in need of a more positive message as the results land at a difficult time for Dentsu reputationally. Although it was not addressed in official earnings statements, it is currently reeling from a high-profile probe into a major corruption scandal from the Tokyo Olympics.

Just over a week ago, Dentsu Inc admitted to illicit bidding in connection with the 2020 Tokyo Olympics; its former assistant director of the sports division Koji Hemmi was arrested along with three other key executives on grounds of allegedly breaching Japanese antitrust laws. Consequently, the Tokyo Metropolitan Government and Osaka Prefecture have now suspended Dentsu and event management company Cerespo from bidding for any government contracts for a year.

This article includes previous reports from Nikita Mishra. This article first appeared on CampaignAsia.com

.png&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.png&h=268&w=401&q=100&v=20170226&c=1)

.jpg&h=268&w=401&q=100&v=20170226&c=1)

.jpg&h=268&w=401&q=100&v=20170226&c=1)