S4 Capital is expecting a 4% decline in like-for-like net revenue in 2023, according to a Q4 trading update, a performance it said was in line with expectations described in its Q3 results.

The group, speaking ahead of March's Q4 results, expects an operational Ebitda margin between 10% and 11% for the full year, an improvement it attributes to "significant cost reductions". Those cost reductions included a 9% drop in headcount between the end of the first half of 2023 and the end of Q3 2023.

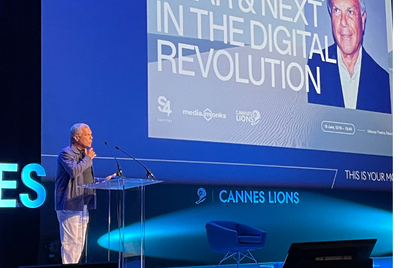

Speaking this morning on the the BBC’s Today, executive chairman Sir Martin Sorrell highlighted the strength of S4 Capital’s first four years of organic growth, admitting that the past 12 months had been “tougher”, while noting some modest signs of recovery.

“This time last year, clients were looking at interest rates rising,” he said. “The slightly better news this year is that they’re now looking at interest rates falling, inflation is coming down quite sharply. It may not reach the core rates that central banks wish, i.e. 2%, but will see how we go through the year.”

Sorrell pointed out the conflict between the global economy and geo-political upheaval – notably the tensions between the US and China, Russia’s invasion of Ukraine and the situation in Gaza.

The BBC challenged whether S4 Capital was becoming a less attractive prospect to investors.

Sorrell said: "If you look at the digital advertising industry the interesting thing about last year was the digital part. The world is about $950bn in terms of media, digital is about $650bn. Of that $650bn, something like $400bn is in the three major platforms – Alphabet, Meta and Amazon – and the growth last year is probably around 10%, though we haven’t seen Q4 results out.

Sorrell described the situation as a "bifurcation between digital and linear" and insisted the model "remains strong and will recover".

The latest statement comes in the wake of a profit warning in November, when the group reported a 15.4% year-on-year decline in Q3 net revenue, leading to an early trading share price drop of about 9%. Total net revenues were £211.5m (vs £249.9m in Q3 2022) and billings including pass-through costs were £450.3m, down 7% on the same period the previous year.

The Q4 and annual results for 2023 will be released on 27 March.

(This article first appeared on CampaignLive.co.uk)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)