Please sign in or register

Existing users sign in here

Having trouble signing in?

Contact Customer Support at

[email protected]

or call+91 022 69047500

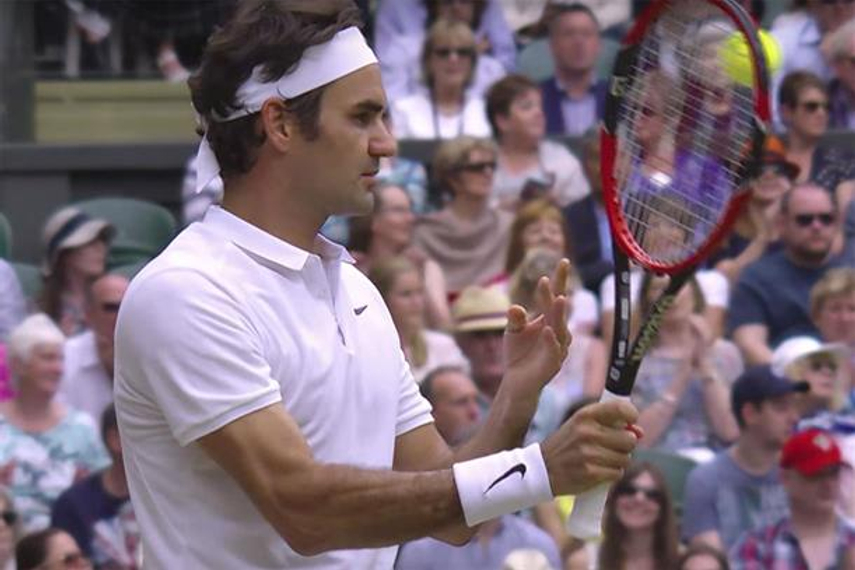

The tennis legend's decision to dump Nike for Uniqlo raised eyebrows at Wimbledon last week, but will customers follow the player to the brand? Richard Payne, the director of Sports Marketing Surveys, investigates.

Contact Customer Support at

[email protected]

or call+91 022 69047500

Top news, insights and analysis every weekday

Sign up for Campaign Bulletins

Is the PR industry on the cusp of widespread redundancies or is the truth a little more nuanced and complicated?

Uber Moto’s IPL stunt taps cricket's cult-like grip, rolling culture, rivalry, and chaos into a social-first, anti-hero caper.

Business leaders are turning to IT firms, AI specialists, and consultancies—not agencies—for their digital transformation needs, according to a new VML report.

As the marketing funnel continues to evolve, the brands that adapt, integrate, and invest smartly will come out as winners, says The Trade Desk managing director.