Online video services are taking the world by storm. Consider this: YouTube today reaches out to more viewers than any English TV channel in India. The production house, Rajshri accounts for a viewership of over 1 billion views from YouTube. The theatrical trailer of Ek Tha Tiger - the Salman Khan starrer – was released on YouTube first before hitting the screens and got two million views in five days.

1. These are just some YouTube numbers. According to ComScore, of the 120 million people using the web in India, 75 per cent consume over 60 million hours of online video content every month. Video on the web is huge in India. Video on mobile is significant as well. “YouTube is our big bet in India - with over 33 million unique users and growing. It has seen 300 per cent YOY growth in 2011 - with one-fourth of views on YouTube India coming from mobile phones,” says Praveen Sharma, head of media sales, Google India.

2. Various revenue models exist in the global market: free such as YouTube that are supported through advertising revenues; pay-per-view or transactional video-on-demand model such as iTunes; and video on demand model such as Netflix where the revenues are generated primarily through subscriptions and they offer ad-free viewing. The market can further be sliced based on the kind of content focus an online video site has. YouTube launched a pay-per-view movie rental service – YouTube Box Office -- in some markets (not India yet) offering premium professional content.

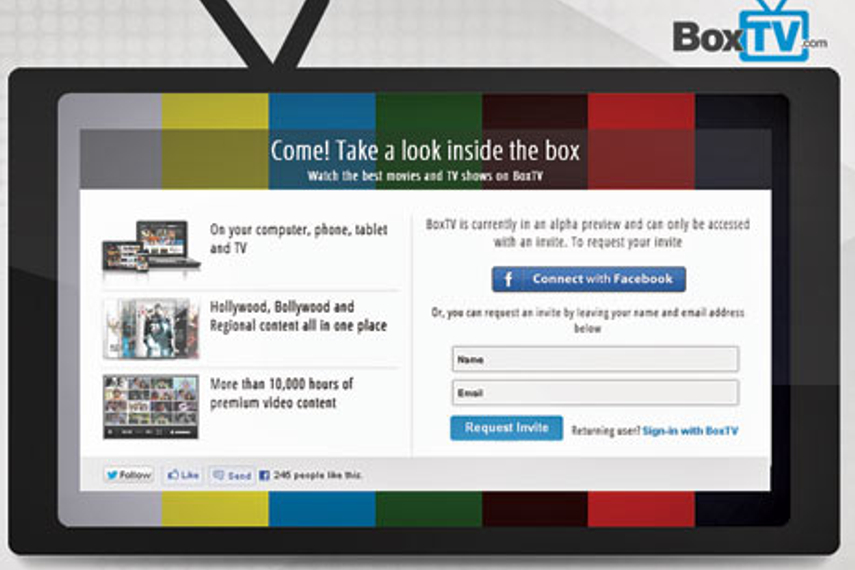

3. In India, Bigflix – a Reliance Entertainment initiative – has a Netflix-like model offering seamless online experience across platforms to price agnostic consumers who are essentially looking to view long format professional content whenever, wherever they want. BoxTV.com, rolled out by Indiatimes.com, is positioned as a ‘freemium’ model. “While it gives free content to the users who want to experience the service but are not ready to pay yet, it also has an option of better and more recent content to users who’re willing to pay for it. Both can be monetised with advertisements,” says Pandurang Nayak, business head, BoxTV.com. If reach is not an issue, as for players likeYouTube, advertising revenue models can be profitable as they don’t need to invest in customer acquisition, but for most new entrants the subscription VOD model is the most viable one. However, the pay-per-view transactional VOD models are still unsustainable in India as the cost of consumer acquisition is very high with almost no loyalty and conversions. “This model works best as a VAS service on mobiles where value packs can be offered to consumers. It is still a few years away in India,” says Manish Agarwal, chief executive officer, Reliance Entertainment Digital.

4. The biggest beneficiary of 3G has been web-based videos on mobiles. Further, with unlimited packs being offered by various service providers, the online video format will continue to grow in leaps and bounds. “Unlike television which is passive and essentially a black hole, mobiles are interactive devices and offer all that a web-based platform does and much more. Video communications on mobile are fast becoming a darling of marketers looking brand showcasing and engagement,” says Agarwal.

5. Advertisers go where their consumers go and it is a no-brainer for advertisers to adopt these channels. They offer all advantages of web as a medium - user profile based targeting, interest based content targeting, engagement led advertising where users can act, ease of tracking and measurement, etc. However, according to Amandeep Khurana, COO, Madison Media, while there is a great future for online video services; most of them are a bit ahead of time in the Indian environment. “YouTube is a phenomenon already and we buy significant inventory over it. However, lack of bandwidth; lack of HD content; and zero interest amongst the audience to get bogged down to a subscription model are factors that show that while there is market for YouTube, Netflix-type models are still far off in India.”

What it means for…

Advertisers

- Exponential growth in online video viewing

- User profile based targeting

- Interest based content targeting

- Video-led marketing communications

Consumers

- Premium content where and when they want

- Ability to access long format video content on mobile

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)