Invalid traffic activity has increased almost universally, according to the Media Quality Report for H1 2022 by Integral Ad Science (IAS).

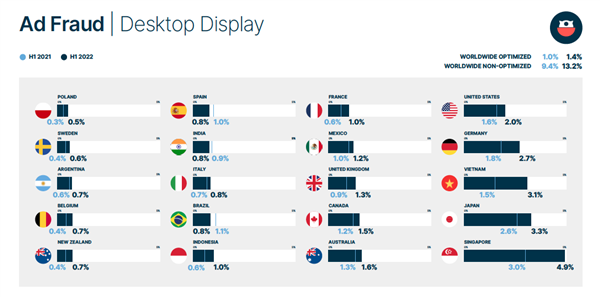

Most markets in APAC saw higher ad fraud rates across desktop display, with Singapore's 1.9 percentage point increase year-on-year (YoY) being the largest, contributing to an overall ad fraud rate at 4.9% in H1 2022. Japan and Vietnam followed with respective ad fraud rates of 3.3% and 3.1%.

Australia (1.6%) and New Zealand (0.7%) posted smaller fraud rate increases, while India lowered theirs by 0.8%. Globally desktop display advertisers saw an ad fraud rates hit 13.2% on average for those not optimised-against-ad fraud, while those with protection in place averaged a 1.4%.

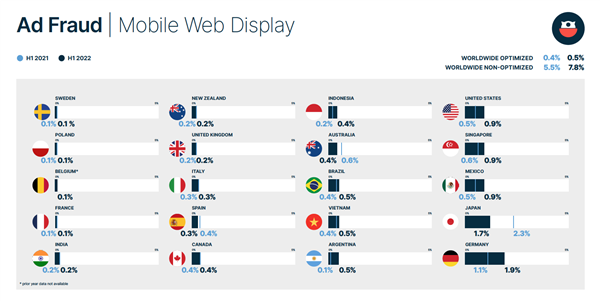

Mobile web display remained safer in APAC than desktop with most markets like Singapore, Vietnam, Indonesia, India and New Zealand keeping the uptick in optimised ad fraud rates below 1%, while Australia and Japan saw declines.

The type of buys across mobile display impressions also had an impact, with programmatic buys in Indonesia, Japan, Singapore and Vietnam registering higher ad fraud rates than direct publisher buys.

Non-optimised ad fraud activity (affecting unprotected campaigns) increased at 10 times the pace of the jump observed for those running with protection (optimised). Globally, mobile campaigns running without anti-fraud protection encountered up to 16 times the amount of ad fraud as optimised-against-fraud rates.

The good news for APAC: Brand risk down, viewability up

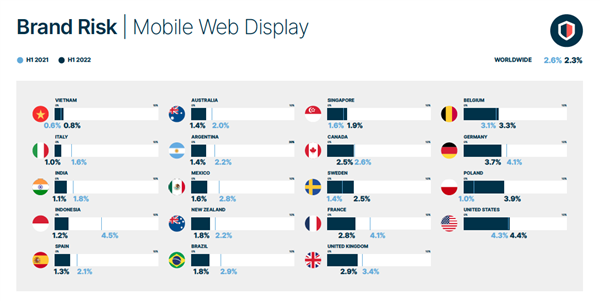

When it comes to reducing brand risk, APAC markets fared well, posting levels lower than the global risk rate average of 2.3%. Indonesia cut its brand risk rate by 3.7 percentage points on desktop display and 3.3 percentage points on mobile web display. Vietnam, meanwhile, had one of the lowest brand risk levels globally on mobile web display (0.8%), despite a slight annual gain.

Violence was the big driver of brand risk for display ad buys globally, which also applied in Australia, Indonesia and Singapore. Illegal downloads were the biggest brand risk for Vietnam, while in India, the primary problem was offensive language.

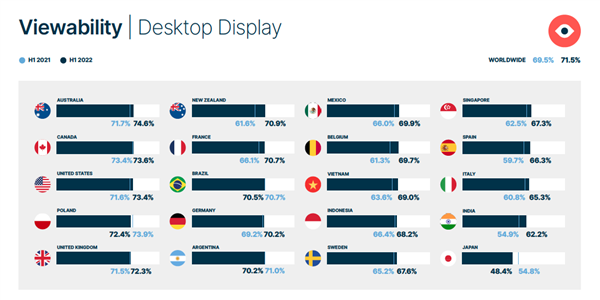

Results around viewability were largely positive, with all APAC markets except Japan seeing an uptick in display viewability. Australian audiences had the highest viewability level at 74.6%, up 2.9 percentage points on year. Other APAC markets reported more than 60% viewability rates. However, Japan's desktop display viewability at 48.4% still sits lowest in the world compared to the global average of 71.5%.

“It’s encouraging to see improved digital media quality performance from emerging markets in the APAC region," said Laura Quigley, SVP APAC at IAS. "Publishers are reviewing their inventory, re-designing their sites to deliver greater attention and viewability for clients, and implementing critical strategies to avoid risk and reduce fraud. Fraud is on the rise, and regional advertisers need to make sure we do not just monitor but also block fraud. The non-mitigated fraud rates could be 10 times higher than fraud rates where mitigation tactics are used.”

(This article first appeared on CampaignAsia.com)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

_3.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)