Franklin Templeton India’s vice president and head of marketing, Geetanjali Sachwani, has a personal connection to the company’s #ChangeTheSoch campaign. While house-hunting in Mumbai, she noticed how real estate brokers would invariably address the male companion with her, despite the fact that she was the one making the financial decisions. This gendered bias in financial matters is precisely what the campaign, launched in October 2024 in collaboration with 82.5 Communications, seeks to challenge.

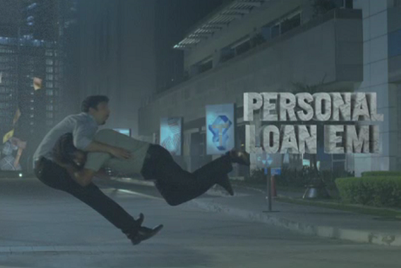

The campaign was built on the insight that financial advice from women is often ignored or dismissed, while the same advice, when delivered by a man, is taken seriously. The films showcase this reality in both workplace and home settings, effectively acting as a conversation starter on the gender disparity in financial credibility.

“We all have a voice. Some a whisper, some a roar. If you can roar, roar for those who can’t. If you can only whisper, keep trying because every roar was once a whisper,” said Sachwani. “A woman with a voice is a strong woman. But the search to find that voice can be remarkably difficult. We have used ‘voice’ to bring a change in ‘soch’. Through this campaign, we are trying to find a voice which calls out that women are equal to men in life and investments.”

This issue is not just anecdotal. Research published on the Social Science Research Network (SSRN), which examined over seven million comments on 200,000 articles on the financial analysis platform Seeking Alpha, found that financial information from men is taken more seriously than the same insights from women. The study concluded that, “Although male and female contributors exhibit similar informativeness and skills, female-authored perspectives receive significantly lower engagement, lower trust, and higher disagreement from platform users.”

Juzer Tambawalla, director and head of sales enablement at Franklin Templeton India, pointed out the increasing number of working women professionals in India, particularly in STEM fields. However, he questioned whether this progress is reflected in the number of women actively making investment decisions.

“Obviously we have women investors. But I’d really question whose decision was that—the man in the house, or the woman actually making her money? That’s what we really want to change, because that really empowers women to take their own decisions, be it in terms of finance, career or participating equally in household decisions,” he added.

Anuraag Khandelwal, chief creative officer of 82.5 Communications, elaborated on the creative process. “It’s always lovely to partner with clients who want to create work that not only engages but also challenges deeply ingrained biases. We created #ChangeTheSoch as an initiative to confront the issue of gender disparity in financial credibility head-on. This campaign highlights the different receptions of identical advice based solely on the gender of the speaker, encouraging viewers to reflect on their own biases. Advertising, when thoughtfully executed, can transcend its commercial purpose and become a catalyst for societal change.”

The campaign employs an unconventional approach: overlaying a man's voice on a woman's speech to demonstrate that the same advice sounds more credible when delivered in a masculine tone. This choice stemmed from Khandelwal’s personal experiences. As a polio survivor, he has faced his own challenges in being heard and understood.

While brainstorming, the 82.5 Communications team chose not to follow a traditional script presentation. Instead, they created a rough-cut video to illustrate the concept visually. Inspired by singers who switch between male and female voices seamlessly, they aimed for a clever, lighthearted approach that would not alienate male audiences. The director, who led a largely female crew, ensured that nuanced touches were added throughout the film.

Sachwani and her team immediately recognised the strength of this storytelling method. “It was a very powerful storytelling approach, because of three perspectives. One is an instant recognition of the bias. The second is the emotional and cognitive disruption that this storytelling approach brings. The third was Franklin Templeton’s philosophy of keeping things simple, which is why the campaign is absolutely lucid and simple without any jargon.”

Data backs up the need for such an initiative. A survey by MYRE Capital, a neo-realty investment platform, found that financial decision-making for women remains largely influenced by men. Only 27% of women investors take independent financial decisions. This study, based on over 5,200 women across Tier I and Tier II cities, highlights the ongoing gender gap in financial autonomy.

Given that men predominantly make financial decisions, was there concern that the campaign might alienate them? Tambawala explained that it was a calculated judgement call. “The message at the end doesn’t say that women are equal or better than men; it says men equal to women equal to men. It’s about equality in opportunity and voice, and that’s what really matters.”

The #ChangeTheSoch campaign generated over 70 million impressions. While many have asked Tambawala whether it has tangibly empowered more women to make investment decisions, he remains pragmatic. “A single film is unlikely to create systemic change, but it is a step towards breaking stereotypes,” he said.

Will Franklin Templeton continue with similar campaigns? According to Tambawala, the focus on women’s financial empowerment remains a business priority. “We want to get more women involved in finance, particularly in making their own investment decisions. We also want more women distributors to take this up as an active profession,” he noted.

Looking ahead, Franklin Templeton is targeting younger audiences who are new to earning and investing but still tend to seek validation from male figures before making financial decisions. As part of its ongoing efforts, the company recently launched another campaign titled ‘Date A Mutual Fund’.

Sachwani explained, “This campaign is about investing time to understand a mutual fund and giving it some time, just like you would in a relationship. We’ve personified mutual funds as human beings and said, ‘Give it some time.’”

Communicating with Gen Z requires a completely different approach. Tambawala acknowledged this shift, stating, “If we want Gen Z to come to us, we have to talk to them in a language they truly understand. That’s why the tonality of the ‘Date A Mutual Fund’ campaign reflects how they actually talk.”

Sachwani admitted that making mutual fund investing engaging for younger audiences is a challenge. “The mutual fund industry can be a little dry, filled with jargon. Communicating in a language that resonates with Gen Z is a challenge, but we’re up for it,” she said.

Franklin Templeton’s social media is managed by two Gen Z employees who may not read financial newspapers daily but stay on top of trends on Twitter and Instagram. Sachwani empowers them to lead social media content creation, trusting their instincts within the company’s branding framework.

The company’s latest campaigns aim to shift how young consumers perceive investing. Rather than seeing it as a dry, complex topic, Franklin Templeton wants to instil the idea that financial literacy and investment require patience, just like any meaningful relationship.

“What we need to do is spend time, get out of our comfort zones, ensure that young investors understand the fundamentals, and then look around for expert help,” said Sachwani. “We want to ensure that we assist Gen Z in becoming more informed investors.”

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)