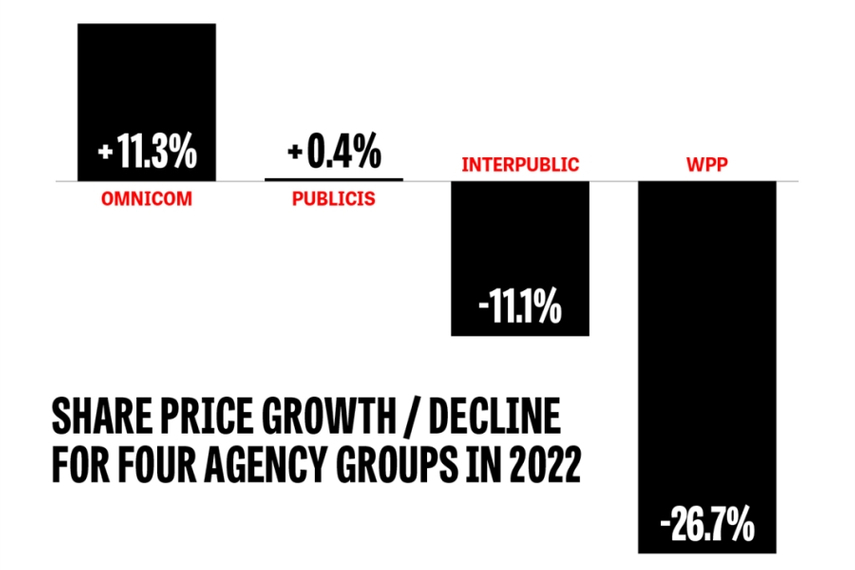

Omnicom’s share price performed best among the leading agency groups in 2022, in what proved to be a tough year for the sector as strong revenue growth failed to offset investors’ concerns about a global slowdown.

US-based Omnicom’s stock price rose 11.3% to $81.57 (£67.23), making it a rarity among its peers as most of the other big agency holding companies saw their valuations flatline or decline.

Paris-based Publicis’ share price was up 0.4% at €59.42 (£52.60) over the year, US-listed Interpublic (IPG) was down 11.1% at $33.31 (£27.45) and Britain’s WPP fell 26.7% to 820p.

Omnicom’s total shareholder return (TSR), which included dividend payments and is a key metric for investors, increased by 15.7% in 2022.

On a TSR basis, Publicis was up 5.9%, while IPG was down 7.8% and WPP was down 23.6%, according to calculations based on Bloomberg data.

The wide divergence in share price performance for the “big four” in 2022 contrasts with their revenue growth, as all of the agency groups reported broadly similar trends, with organic sales forecast to be up between 6.5% and 8.5%.

That rate of growth is behind 2021 levels, when the market bounced back from the worst of the pandemic, but was much faster than in the years that immediately preceded Covid. However, the impact of the Ukraine war and soaring inflation have been weighing on investor sentiment.

WPP’s declining valuation

At current valuations, Omnicom’s growth means it is the world’s most valuable agency group (worth about $17.5bn), ahead of Publicis (€15.5bn/$16.6bn) and then IPG ($13.6bn) with WPP in fourth (£9.4bn/$11.5bn).

Financial market sources said the relative strength of the US ad market had benefitted Omnicom, Publicis and IPG because each generates between 50% and 65% of global revenue from North America. This is in contrast to WPP, which brings in about 35% of sales from the region and has higher exposure to Europe and the rest of the world.

Omnicom, in particular, got a boost in 2022 after previously underperforming the sector at the start of the pandemic.

Sources also suggested London-based WPP may be suffering from broader investor concerns about UK stocks and sterling’s weakness.

Silchester, a UK investor, has quietly built up a stake of more than 5% in WPP – a threshold that it reached at the start of November 2022 – to become the third largest shareholder.

A source close to WPP dismissed suggestions that it was under any pressure to restructure or sell assets as a result of its declining stock price after a report in last weekend’s Sunday Telegraph about Silchester’s interest.

“WPP has transformed its business in the past four years, substantially strengthening its balance sheet while also returning very significant funds to shareholders,” a WPP spokesperson told the newspaper. They added that “the success of the proactive simplification of its business was demonstrated” by its big, global Coca-Cola win at the end of 2021.

WPP’s share price rose 2.5% to a six-month high of 887p on news of the Silchester stake but that is still about half of its 2017 peak.

Investors will typically take a long-term view to decide on the merits of a company.

IPG was the best performing large agency stock in 2021. On a three- and five-year basis going back to 2020 and 2018 respectively, IPG and Publicis performed best on TSR, ahead of Omnicom and WPP, data shows.

Beyond the “big four”, other established and new agency groups had mixed fortunes in terms of share price performance last year.

Dentsu’s share price was roughly flat and Havas owner Vivendi was down about a quarter.

Consulting giant Accenture, which rebranded its agency operation as Accenture Song last year, dropped by about one third. S4 Capital lost two-thirds of its value after a series of accounting delays and a profit warning.

Many digital media stocks from Amazon and Apple to Meta and Netflix were hit by a broader slowdown in the technology sector and parts of the online ad market in 2022.

(This article first appeared on www.CampaignLive.co.uk)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=268&w=401&q=100&v=20250320&c=1)