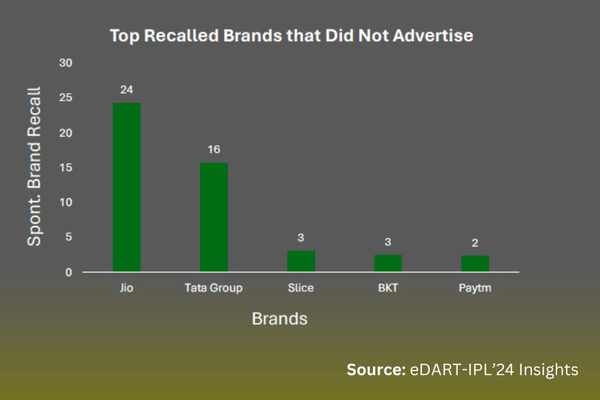

Jio, Tata Group, Slice, BKT, and Paytm emerged as the most recalled brands of IPL 2024 despite not investing in conventional advertising modes, according to the latest, eDART-IPL24 report released by Crisp Insight and Kadence International.

The findings from this latest study on IPL advertising bust the myth that heavy spending on conventional advertising at IPL can assure high consumer recall, and on the contrary, underlining the importance of the non-free commercial time advertising (non-FCT) options such as team sponsorships, stadium branding, and TV screen placements.

The report reveals the sharp difference between gross rating point (GRP) expenditure and the actual brand recall. For instance, Dream11, with 1,730 GRPs and a well-executed advertising and sponsorship mix, emerged as the most effective advertiser with a 37.7% recall. However, My11Circle, with a smaller spend of 634 GRPs, also saw a strong 14% recall, highlighting the critical role of strategic messaging, creative execution, and brand integration with IPL. In contrast, Vimal achieved only 2.4% recall in spite of spending 3,016 GRPs. Similarly, Parle, with 2,615 GRPs, saw 4.1% recall, and Kamla Pasand, with 1,902 GRPs, managed only 4.2% recall, the report observes.

Aman Makkar, managing director. Kadence International, said, “IPL is one of the most competitive advertising platforms, and with numerous brands vying for attention, standing out requires more than just high ad spends. Strategic sponsorships, in-stadium branding, and seamless brand integration within the event ecosystem are proving to be equally—if not more—effective in driving recall and engagement.”

The report specifies 200 GRPs as the minimum threshold for notable brand recall, with just 30 of 100+ advertisers surpassing it. Non-FCT visibility tactics helped brands like Slice and Paytm to attain recall as high as 200 GRPs without direct advertising. The report notes that as per the IPL 2024 data, fantasy sports and fintech brands making use of in-game integrations achieved the highest recall, while conventional advertisers fell behind.

Stating that brands must rethink their IPL marketing approach and balance traditional advertising with recall-focused placements, CrispInsight founder Ritesh Ghosal said, “Sponsorships and strategic brand placements are proving to be just as powerful, if not more, than traditional advertising in high-impact events like IPL. Jio, Tata Group, and Paytm’s strong recall without conventional ads reinforces that visibility-driven strategies are critical to maximizing impact.”

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)